Before I get all insurance-y on you here are a couple of quirky things about me, because I’m a fan of you and I don’t want you mad at me over insurance talk.

- I am way into fun. I resolutely endeavor to make the not-so-fun stuff at least interesting, possibly motivating and at most we shall laugh. And laughing is unequivocally fun.

- I have this strange thing I do. Oh, it’s not too strange… I’ve occasionally met others like me, and you and I? We may even have this certain thing in common. Onward to the thing: I break into song. You may say to me in the midst of a joke, “stop me if you’ve heard this before” and I’ll bust out singing “Stop Me if You Think That You’ve Heard This One Before,” by The Smiths…

I try to control it, keeping it held-up in the silly section of my brain, but most of the time it abruptly slips right on out of my mouth. I’m not a rock-star either. How not very nice for you.

Okay, now that you know me just a smidge more than before, here’s the part where I let you in on the mind-blowing insurance pursuit I am on right now.

HINT: This is also the part where you stick around past hearing the mind-blowing pursuit because you kind of like me now. Ready?

October is Cyber Security month, YES! And I am bursting forth with way more than I plan to share on Cyber Liability insurance!

→SO before we get to the fun, you do need to know that this is actually slightly serious, and from what I’m reading, small businesses are not taking it seriously enough.

You’re probably feeling a bit like this guy right now…

I get it; I really do and me too.

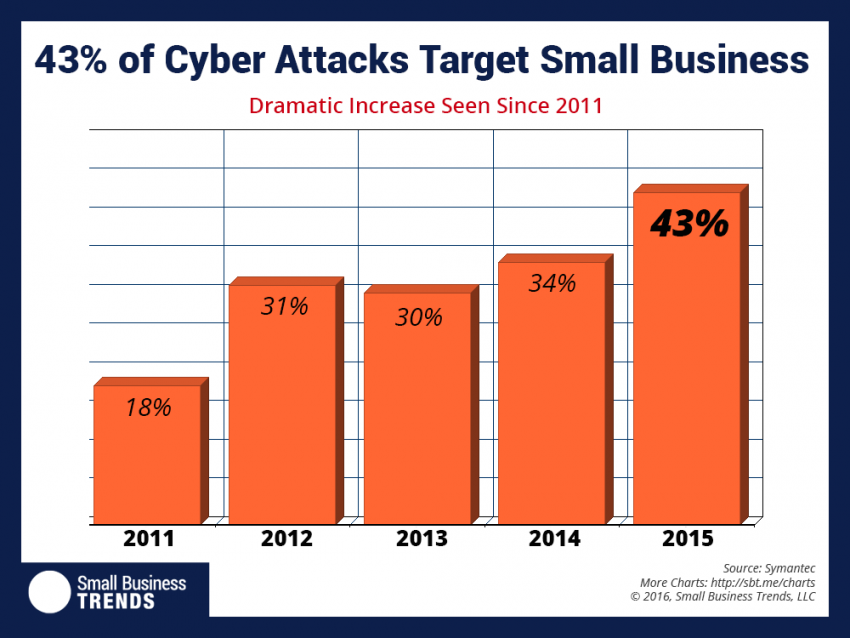

However, cyber-attacks on small businesses are increasing rapidly with each passing year. In fact, 43% of cyber-attacks in 2015 specifically targeted small businesses.

Take a look:

Why small businesses?

It’s certainly NOT from lack of cyber liability insurance. Though, I guarantee you’ll wish you had it if your small business is invaded by someone lurking on the other side of the dark web.

Small businesses are preferential targets for cyber-criminals. They wrongly assume that their smaller size eliminates them from the risk of a destructive data breach. It’s just this kind of thinking that has small businesses placing their data security plans of action into the I’ll-get-to-that-later/never pile. It’s also just this kind of thinking that places them right on top of the data-breach bandit’s priority list.

What to do?

- Understand what you’re dealing with. Download these informative reports: 2016 Data Breach Investigative Report (DBIR) by Verizon 2016 Internet Security Threat Report (ISTR) by Symantic.

- Call us! Cyber Liability insurance is designed to protect your small business, your brand, your money and your clients in the unfortunate event of a data breach. We will provide you with a FREE Cyber Risk Exposure Scorecard and a Cyber Security Planning Guide for your office.

Lastly, I so hope you stuck around for the fun part! My trio of music motivation for Cyber Security Month courtesy of Hall & Oates!

Remember, I warned you… “Private Eyes Are Watching You!”

I wrote this blog just for you because… “I Can’t Go for That, No Can Do!”

And if your small business falls prey to a data breach without Cyber Liability insurance, you’ll be singing… “Say it Isn’t So!”